I recently had lunch with a CFO friend for an emerging medical device company. Since I hadn’t seen him in a while, I wanted find out how the startup was progressing. I was especially interested if there might be acquisition potential. This would meet my recently developed interest in the process involved with discovery, selection and integration of startups. I was curious if the failure rates (dismal ROI levels) are still what they used to be. Maybe there was something I could learn?

Did I hit the jackpot!

Steve told me the company he works for had indeed been acquired some 6 months ago and is now in the middle of the integration process.

Such as it is.

He proceeded to relate how, from his perspective, this acquisition and the subsequent integration process was fraught with missteps that made this acquisition significantly more difficult than projected.

Some of the major issue I heard were:

- Lack of clear strategy and requirements

- Lack of pre-deal making comprehensive due diligence

- Forcing two cultures together that do not have synergy

- Lack of clear integration playbook addressing

As a consequence, this deal is currently walking a tightrope. The acquisition will not be unraveled, but will the ROI be there and, more importantly, will the components of the acquisition target that caused interest initially remain after the integration process is ‘complete’?

Here is the biggest ROI killer for this company:

The investors in the acquiring company decided to bring in consultants to help ‘right the wrongs’ and save the integration from becoming a total failure!

Corporate Venturing is popular

More and more medium and large organizations are looking to acquisitions and partnerships as a roadmap to growth or access to revenue sources. As you consider the number of (near) failures, the need for a different approach to integration becomes clear. Success is less a factor of ‘good dealmaking’ than ‘smart integration’.

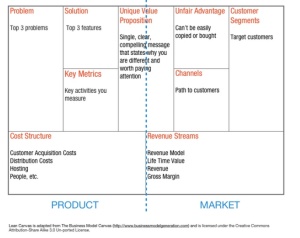

A recent blog by Steve Blank makes clear why. Steve’s insight in this article was the realization that startups traverse various stages of development, roughly divided into ‘searching‘ for a business model, customer base, etc., and ‘executing‘ on what they found has gelled.

Even with this insight, most companies will stumble trying to integrate young companies to leverage their ‘secret sauce’ as we saw above. Bringing in innovation from outside the company is difficult to do, but there are companies that are successful at it, such as Cisco. This suggests that it is possible, at least to achieve a substantially positive result to an innovation adoption program.

A Mature Innovation Integration Process

Approaching this from my experience with Alliance Management, I came up with 10 components of a mature integration process. To significantly improve the success rate and thereby the ROI, all components should be included, as in the weakest link determines the outcome. I would use this for complete acquisition integration, as well as for arms-length involvement after investment in an earlier startup.

1. Don’t connect with Corporate Strategy

Finding and bringing innovation that was developed by a startup shouldn’t happen in a vacuum. ‘Start with the end in mind’ sounds like an appropriate mantra here. If it is not strategically important to your organization’s sustained success, maybe you ought to be intrigued but not spending corporate resources on bringing it inside.

2. Monitor only what’s in your own backyard

There is a lot happening in incubators and accelerators throughout the country these days, even throughout the world. Keeping up with all that is not going to be easy. Start with developing criteria for what you are looking for (tied to your strategic goals), what the right time is for getting involved (by making an investment or acquisition), and how you are going to monitor. Are you interested in tracking for process innovation? Product or core technology innovation? Or maybe access to markets or audiences you have not been able to open up yourself with your existing business model?

At the same time, it is not going to be sufficient to just focus on what’s happening in your own backyard. Even if that backyard is Silicon Valley. New business models, technologies, etc. are increasingly being developed in places where the market problem is. Establish a model for keeping your organization’s finger on the pulse in multiple settings. Maybe you are content with 5 hot startup locations? Assign a market to each team member of the corporate venture team. If you believe you need broader coverage, you may need to engage an outside firm to organize access and exposure for you.

3. Select whatever looks good today

Here is where Steve’s point comes back into focus. If your strategy tells you that you should be looking for ‘chaos’ candidates, where are they? Do you know what you are looking for? What level of ‘chaos’ can you work with as you are observing and learning from the startup?

- Is learning from the startup a goal?

- Are you primarily interested in leveraging the opportunity for revenue increases from the acquisition?

- Maybe you are more interested in the technology.

These days, large companies also engage in ‘acquihire’, the acquisition of a company for their employees, rather than the technology.

Regardless, the more generic your search criteria, the greater the number of startups that will fit the bill. With specific criteria comes a selection and evaluation checklist that will invariably have ‘yes’ and ‘no’ entries. Include in this risk assessment not only the ‘now’ risks, but also the ‘future’ risk items, based on prior experience. Establish a process of prioritizing and evaluating as a team which candidate looks best on paper.

4. Just get started

The reasons for wanting to get involved with a particular startup are many, and so will the goals for the integration be. Set up guidelines and reference points for the team to use when formulating specific goals for specific integration opportunities. It will make the process measurable as well as repeatable. The result is a much more efficient and effective execution, even though adjustments ‘on the ground’ will always be necessary. They are easy to make because you now have a playbook template, connected to overall strategic goals.

5. One size fits all

Each one of the three targets (going concern, beginning to execute, still searching for a business model) demands a different approach, mix of skills and experience involved in the team, even a different target speed of process.

The due diligence phase of considering investment in a target should include tasks to determine these aspects and formulate the specific playbook this specific opportunity will require in order to secure the greatest potential for successful integration.

6. Do the deal and hand it off

Think your Corporate Venture team can handle it?

If you are just interested in ‘The Deal’, then, yeah, probably.

But if you are interested in successful leverage by your corporation, you have to think harder and smarter.

The central perspective should always be sustainability of the integration effort. Depending on the startup involved, there may be a need for different individuals to join a core team. Who do I need to involve now to ensure future success, and, who do I include at the appropriate time on the roadmap?

7. Adopt and follow a process that is dynamic and flexible

One of the core challenges with integration at many companies is that the team tends to use the same process, same success criteria, even the same team members, every time.

Better success rates can be achieved by having a process that takes into account realities such as:

- What is the object of integration?

- What is the development stage of the company?

- What is domain expertise does the technology, process, etc. require?

- What areas of the company will benefit from the integration?

This enables the team to make adjustments to the playbook template to ensure the greatest potential for leverage and ultimate success of the integration efforts

8. Just tell me when it’s finished

Metrics, metrics, metrics.

There are several layers of metrics to consider here:

How is the startup doing?

Now that I have a (potential) interest in this company, I want to understand if they are making progress moving from searching to executing. If you are getting involved with a team that uses some form of ‘lean startup’ techniques, this should make your life a lot easier. If they are not, well …..

How is the integration execution coming along?

Are we executing to plan, making progress, leveraging what the startup has to offer?

How is our playbook success rate?

In other words how are we learning from our activity and where can we fine tune our approach?

9. On-boarding is for sissys

Consider the “what’s in it for me?” question that is sure to sabotage less-then-well-planned integration efforts. Given the observation that existing corporations are about efficiency and optimization of the business model, innovation will quickly be seen as disruption and threat. So the playbook must include considerations of culture, change management and even hard incentives to change ‘the way we’ve always done it’. Don’t make the mistake, as they appear to have in my friend’s company, of forcing an innovation company into a ‘slow and steady as she goes’ environment if the culture of innovation and some level of chaos is what was attractive in the first place

10. I’ll never do this again anyway

Finally, if you are looking outside for innovation that will help sustain your business, maybe you should take a look at the business model innovations that made your acquired startup to what it is today. Can you learn from their updated concepts, processes, cultural and professional attitudes to ‘update’ your business, division, department, etc.? The acquisition of a startup provides a unique opportunity to help bring in change in various aspects of your business that your executive team is not able to achieve from within.

Conclusions & Recommendations

Companies that are serious about strategically bringing in innovation from outside can be very successful in doing so, provided they understand:

- when to engage with each individual opportunity,

- how to approach each opportunity on its own merit,

- which professional skills to bring to the process,

- and how to use a well thought out, standardized playbook template.

There is lots to discuss about this topic and I always look forward to learning from others engaged in this area. I plan to discuss each of the components in more detail in upcoming blogs.

10 ways to derail the integration of a startup was originally published on Allinnova

How to create the basis for success when your organization is new to collaboration.

How to create the basis for success when your organization is new to collaboration.

You must be logged in to post a comment.